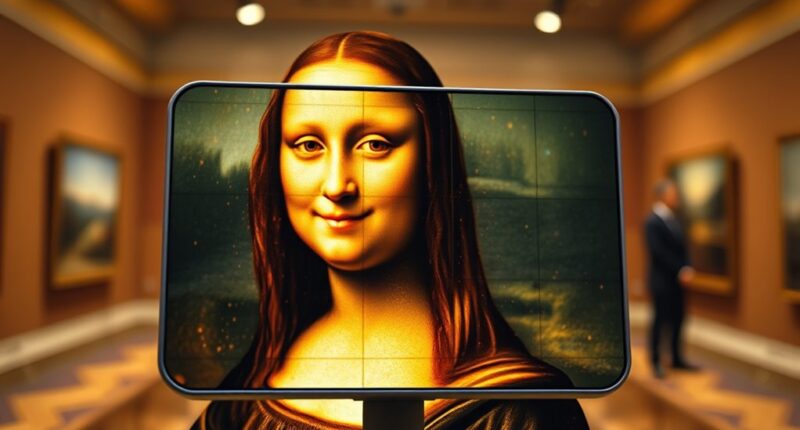

With fractional NFTs, you can own a small part of a high-value artwork like the Mona Lisa, making it more accessible and affordable. Instead of buying the entire masterpiece, you purchase fractions that can be traded or held as investments. This approach democratizes access, allowing more people to participate in owning coveted digital assets. If you want to discover how this works and what benefits it offers, there’s more to explore beyond this overview.

Key Takeaways

- Fractional NFTs enable ownership of high-value digital assets like artworks in small, tradable shares.

- This approach makes collecting famous artworks accessible without purchasing the entire piece.

- Investors can buy, sell, or trade fractions, increasing liquidity for valuable digital assets.

- Community-driven ownership fosters shared responsibility and potential value growth of the artwork.

- Fractionalization democratizes access, allowing more people to participate in owning iconic digital assets.

Have you ever wondered how you can own a piece of a valuable digital asset without buying the entire thing? That’s the power of fractional NFTs. Instead of shelling out millions for a one-of-a-kind artwork or collectible, you can purchase a fraction—say, 1/10,000th—of the digital asset. This approach makes digital ownership more accessible, allowing you to invest in high-value items without needing a fortune. By dividing NFTs into smaller, tradable portions, fractional ownership opens the door for more people to participate in the digital collectibles market.

When you own a fraction of an NFT, you’re not just buying a tiny piece—you’re gaining a stake in something that can be valuable and rare. This setup democratizes access to assets that were once out of reach for most. Plus, fractional NFTs can help diversify your digital portfolio, spreading your investment across multiple assets rather than putting all your money into one expensive piece. This diversification can be especially beneficial in a volatile market, giving you more control over your digital assets.

Market liquidity is another key advantage of fractional NFTs. Traditional high-value assets like paintings or rare collectibles often have limited buyers, making it hard to sell quickly or at a fair price. But with fractional NFTs, liquidity improves because you can trade your small share on various platforms, often with minimal hassle. This increased market liquidity means you’re more likely to find a buyer when you want to sell, and you can do so in smaller, more manageable increments. The ability to easily buy and sell fractions of NFTs makes the market more dynamic and efficient, encouraging more active trading and investment.

Furthermore, fractional NFTs help foster a community of collectors and investors. Instead of owning a piece of a digital asset in isolation, you’re part of a shared ownership, which can lead to joint decisions or collaborations. This collective approach can drive up the value of the asset over time, especially if the community actively promotes or adds to its desirability. Additionally, understanding the importance of contrast ratio in digital displays can enhance your viewing experience when engaging with these assets visually.

Frequently Asked Questions

How Is Ownership of a Fractional NFT Legally Recognized?

You might wonder how legal recognition of ownership rights works with fractional NFTs. When you buy a fractional NFT, the legal system typically recognizes your ownership through digital asset laws and smart contracts that record your stake. These contracts define your rights and prove your ownership, making it enforceable. However, laws vary by jurisdiction, so it’s essential to understand how legal recognition applies where you are, ensuring your ownership rights are protected.

Can Fractional NFTS Be Used as Collateral for Loans?

You can use fractional NFTs as collateral for loans on certain marketplace platforms that recognize their value. These digital art assets are increasingly accepted because they represent ownership stakes in valuable collections. When you pledge a fractional NFT, lenders evaluate its market worth, and you can secure a loan against it. Just guarantee the marketplace platform supports such transactions and that the fractional NFT is properly valued and verifiable.

What Are the Tax Implications of Owning Fractional NFTS?

When owning fractional NFTs, you need to consider tax reporting and capital gains. If you sell your fractional NFT at a profit, you’ll owe taxes on capital gains, which vary based on your holding period and income level. Keep track of your acquisition and sale prices, and report these details accurately. Failing to do so could lead to penalties, so stay informed about tax regulations related to your fractional NFT investments.

How Do Voting Rights Work With Fractional NFT Ownership?

With fractional NFT ownership, your voting rights depend on the digital governance and voting mechanisms set by the platform or project. Typically, each fraction grants you a certain number of votes, allowing you to influence decisions like transfers or management. You actively participate by using your voting power through secure digital platforms, ensuring your stake is reflected in governance processes. Always check the specific rules of each fractional NFT to understand your rights fully.

Are Fractional NFTS Inheritable or Transferable Like Traditional Assets?

Fractional NFTs are generally inheritable and transferable like traditional assets, but you need to contemplate digital inheritance and transfer procedures. You should set up secure digital wallets and include instructions for inheriting your NFTs in your estate plan. Transferring ownership typically involves verifying identity and following platform-specific steps. Keep in mind that laws and platform policies can vary, so it’s wise to consult an estate professional for smooth digital inheritance.

Conclusion

Now, owning a fractional NFT lets you hold a piece of iconic art like the Mona Lisa without breaking the bank. It’s a game-changer for art enthusiasts and investors alike, making valuable pieces more accessible. As the market grows, you can enjoy the thrill of ownership and the potential for appreciation, all while supporting the digital art community. Embrace this innovative way to connect with history and creativity—your chance to own a piece is just a click away.