If you’re worried about being cheated on payouts in mining pools, it’s crucial to evaluate security and transparency. Poor security measures can lead to stolen funds or manipulated payout records, while lack of transparency can hide discrepancies. To protect yourself, research pools with strong reputations, clear payout systems, and robust security practices. Staying informed helps you spot issues early. Keep exploring to learn how to identify trustworthy pools and ensure fair payouts every time.

Key Takeaways

- Verify the pool’s payout transparency through real-time dashboards and clear payout schedules.

- Research the pool’s reputation and user feedback to identify potential red flags.

- Ensure the pool employs strong security measures like encryption and regular audits.

- Watch for irregular payout patterns or discrepancies that may indicate manipulation.

- Avoid pools with a history of disputes, irregular payouts, or suspicious activity.

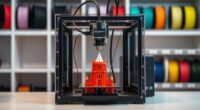

Mining pools are collaborative groups where cryptocurrency miners combine their computing power to increase the chances of successfully solving cryptographic puzzles and earning rewards. When you join a mining pool, you’re pooling your resources with others to improve your chances of earning a payout. However, as straightforward as this sounds, you need to pay close attention to how the pool operates, especially regarding pool security and payout transparency. These factors directly impact whether you’re being fairly compensated or potentially being cheated.

Pool security is critical because it safeguards your earnings and personal data. A secure mining pool uses robust encryption protocols, secure login procedures, and regular security audits to protect against hacking attempts and fraud. If a pool neglects these security measures, your earnings can be at risk. For example, a pool without proper security might become vulnerable to cyberattacks, which could result in stolen funds or manipulated payout records. When evaluating a pool, always ask about their security practices, check for reviews, and verify if they have a history of handling security breaches responsibly. Additionally, a reliable pool often employs advanced technology to monitor and maintain its security infrastructure effectively.

Secure mining pools protect your earnings with encryption, login protocols, and audits—always verify their security practices before joining.

Payout transparency is equally important. You want to know exactly how much you’ve earned and when you’ll receive your rewards. Some pools operate with clear, detailed dashboards that display your mining statistics, contribution levels, and payout history in real-time. Others might be less transparent, offering vague or delayed payout information that leaves you uncertain about your earnings. Be wary of pools that don’t provide clear payout details or that have inconsistent payout schedules. Transparency not only builds trust but also helps you detect any discrepancies early. If a pool’s payout system isn’t transparent, you risk being shortchanged or not knowing if your contributions are accurately credited.

When choosing a mining pool, research their reputation thoroughly. Look for pools with positive user feedback, a transparent payout system, and strong security measures. Avoid pools that have a history of disputes or irregular payouts. Keep in mind that even with the best security and transparency, no system is flawless, but reputable pools make it easy for you to verify your earnings and trust that your contributions are fairly rewarded.

In the end, you want to join a mining pool that prioritizes both pool security and payout transparency. These qualities help ensure that your efforts are genuinely compensated and that you’re not being cheated on payouts. Stay vigilant, do your homework, and choose a pool that openly demonstrates its commitment to fair and secure operations. That way, you can mine with confidence, knowing your rewards are protected and accurately reflected.

Frequently Asked Questions

How Can I Verify a Mining Pool’s Payout Accuracy?

To verify a mining pool’s payout accuracy, you should first check the pool security measures they have in place. Look for transparent payout reports and detailed payment logs, which indicate payout transparency. Compare your expected earnings with the actual payouts and monitor any discrepancies. Using third-party monitoring tools can also help guarantee the pool’s payouts align with your mining contributions, giving you confidence in their honesty.

What Are Common Signs of Payout Manipulation?

You should watch for signs of payout manipulation, like inconsistent payouts or sudden changes without explanation. A lack of payout transparency can be a red flag, indicating the pool might be concealing details. Check the pool’s reputation online—if many users report discrepancies, it’s a warning. Trust pools that openly share payout data and have positive reviews, so you can avoid potential scams and guarantee fair compensation for your mining efforts.

Are There Transparent Mining Pools With Open-Source Payout Algorithms?

You’ll find that some mining pools prioritize blockchain transparency by offering open-source payout algorithms. These pools provide clear, verifiable code, allowing you to see exactly how payouts are calculated. The open-source advantages include increased trust and accountability, helping you avoid potential manipulation. Look for pools with transparent documentation and active communities, ensuring you join a reputable, open-source mining pool that fosters honesty and fairness in payouts.

How Do Payout Schemes Affect Overall Mining Profitability?

You should know that payout schemes directly impact your mining profitability. When a payout method favors frequent, smaller payments, it can reduce your overall earnings, especially if network difficulty rises. Conversely, schemes that match your block reward with stable payouts can maximize your gains. Always consider how payout structures align with network difficulty changes to make sure you earn the most from your mining efforts.

Can I Switch Pools Without Losing Accumulated Rewards?

When you switch pools, your ability to keep rewards depends on how the pool handles reward tracking. Many pools allow you to switch without losing your accumulated rewards if they use proper payout schemes and track your contributions accurately. However, some pools may have policies that make it tricky or delay your rewards during pool switching. Always check their reward tracking methods beforehand to guarantee a smooth transition and protect your earnings.

Conclusion

So, always stay vigilant and double-check your mining pool’s payout methods. Don’t just trust what they tell you—look into their reputation and transparency. If something feels off or seems too good to be true, it probably is. Keep track of your earnings and compare them regularly. Remember, being informed helps you spot potential scams and guarantees you’re fairly compensated for your mining efforts. Stay smart and protect your hard-earned rewards.