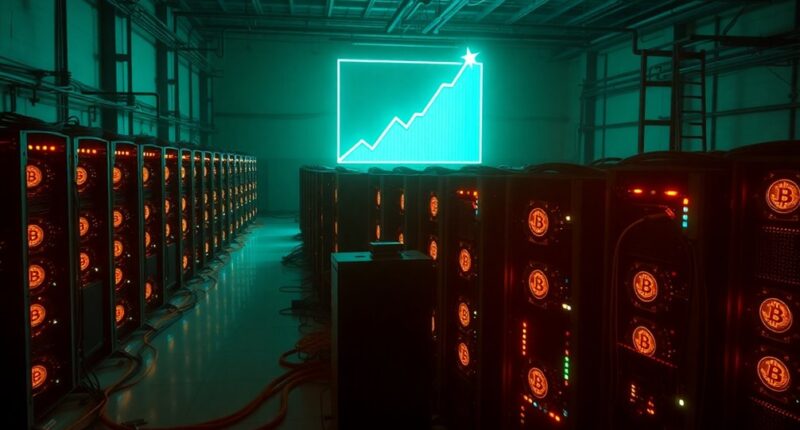

You've likely noticed the recent 8% surge in Bitcoin's hashrate, a clear sign that miners are bouncing back from the challenges they've faced. This growth isn't just a number; it reflects significant changes in mining efficiency and regulatory stability. As the mining community adapts, the implications for network security and operational strategies could be profound. What does this mean for the future of Bitcoin mining and its broader impact on the market?

As Bitcoin's hashrate surged by 8%, it signals a promising recovery for miners who've faced numerous challenges over the past year. This growth reflects a significant 56% increase in hashrate over the last twelve months, showcasing the resilience and adaptability of the mining community.

With more computing power dedicated to the blockchain, miners like you can rest assured that network security is on the rise, reducing the risk of attacks and ensuring smoother transactions.

You might've noticed the fluctuations in Bitcoin's hashrate, but the upward trend remains clear, supported by increased mining activity. Historical patterns suggest that such growth often follows major events, like China's mining ban, which pushed miners to seek greener pastures.

As the industry evolves, projections indicate that the hashrate could reach an impressive 1 zettahash per second by 2027, assuming a conservative growth rate. This potential growth means that now's a great time to consider the long-term viability of your mining operations.

Several factors are influencing this hashrate surge. The introduction of more efficient mining equipment allows you to maximize your output. Hut 8's hashrate forecasted to increase due to their recent purchase of Antminer S21+ machines, which will enhance overall operational performance. However, rising energy costs pose challenges that require careful management.

When Bitcoin's price is on the rise, market sentiment shifts positively, encouraging you to expand your operations. The regulatory landscape also plays a crucial role; as it stabilizes, you may find it easier to invest in new technology.

Moreover, Bitcoin's price volatility directly impacts your revenue streams. Higher prices increase the USD value of block subsidies, enhancing profitability and allowing you to reinvest in your mining setup.

When prices soar, market optimism can lead to significant investments in mining infrastructure, creating a competitive edge for those who act swiftly.

Major mining companies are also capitalizing on the surge. Firms like Hut 8 are expanding their operations, purchasing new equipment to boost hashrate.

Others, such as CleanSpark and Riot Platforms, are seeing benefits from the increased Bitcoin price, showcasing the interconnectedness of price and mining success. As these companies thrive, their stock prices reflect broader industry optimism, which could influence your own investment decisions.